Entertainment Expense

Background

Company annual dinner, incentive trip, gift vouchers, lucky draw, hampers for customers during festive seasons, etc are some of the spendings enterprises will be incurred for its employees, customers and/or suppliers.

However, not all above expenses are subject to 100% tax deduction.

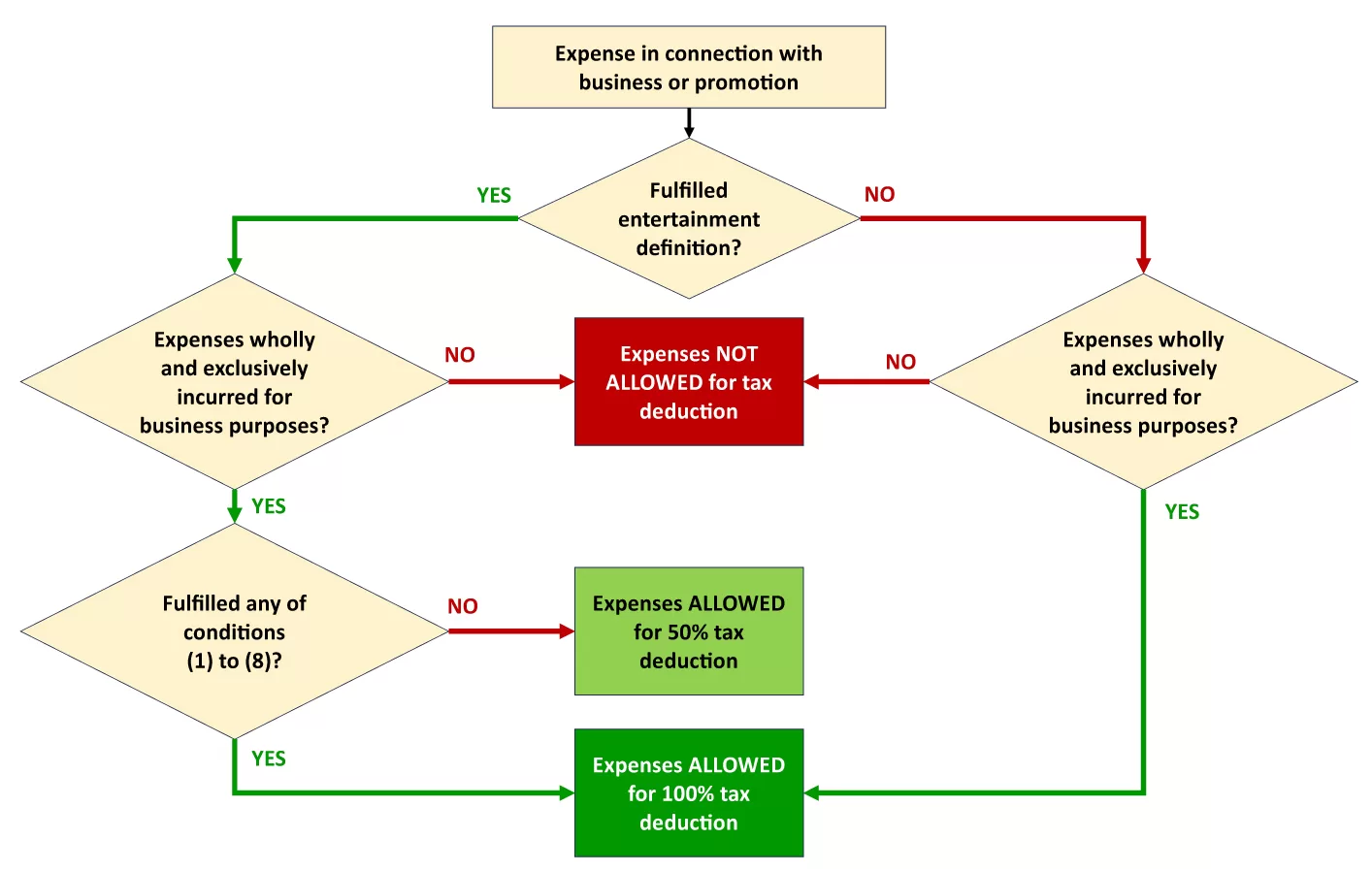

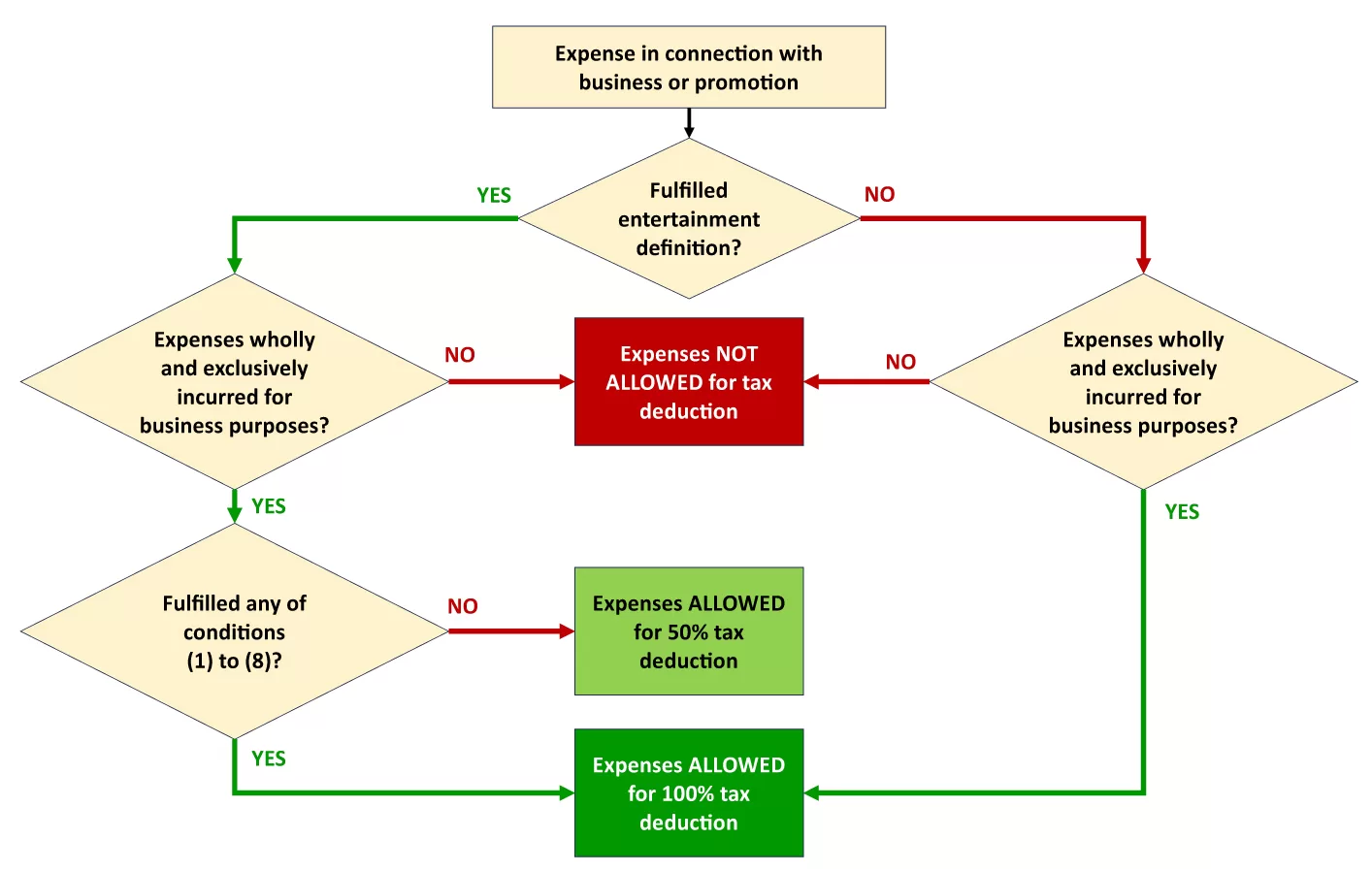

Check out below Process Flow Diagram of Entertainment Expense for ease of reference.

Tax Law and Regulations

- Section 18 of Income Tax Act 1967 (“the Act”)

“Entertainment, includes:

(a) the provision of food, drink, recreation or hospitality of any kind; or

(b) the provision of accommodation or travel in connection with or for the purpose of facilitating entertainment of the kind mentioned in paragraph (a),by a person or an employee of his, with or without any consideration paid whether in cash or in kind, in promoting or in connection with a trade or business carried on by the person.” - Section 33(1) of the Act

- Section 39(1)(l) of the Act

- Public Ruling No. 4/2015 (Published on 29 July 2015)

Application

- Entertainment expense qualifies for 100% tax deduction

In order to enjoy 100% tax deduction, the entertainment expense must be wholly and exclusively incurred in the production of business gross income and fulfilled either of below conditions:

| No. | Conditions | Example | |||||||||

| 1 | The provision of entertainment to his employees except where such provision is incidental to the provision of entertainment for others. | Free meals and refreshment, annual dinners, outings, family day or club membership for employees. | |||||||||

| 2 | The provision of entertainment for payment in the ordinary course of business. | Cultural shows provide by restaurants or hotels at their premises to entertain their customers. | |||||||||

| 3 | The provision of promotional gifts at trade fairs or trade or industrial exhibitions held outside Malaysia for the promotion of exports from Malaysia. | Samples of business products, small souvenirs, bags, and travel tickets provided as gifts to customers or visitors at the trade fairs, trade exhibitions or industrial exhibitions held outside Malaysia. | |||||||||

| 4 |

The provision of promotional samples of products of the business. |

Free sample of products of the business given to schools. | |||||||||

| 5 | The provision of entertainment for cultural or sporting events open to members of the public, wholly to promote the business. |

|

|||||||||

| 6 | The provision of promotional gifts within Malaysia consisting of articles incorporating a conspicuous advertisement or logo of the business. | Notes:

|

|||||||||

| 7 | The provision of entertainment related wholly to sales arising from the business. | Example:

Note:

|

|||||||||

| 8 | The provision of a benefit or amenity consisting of a leave passage benefit (cost of transport fares) provided by an employer to its employees to facilitate a yearly event within Malaysia, which involves the employer, employee and immediate family members of that employee. | Family day trip for employer, employees and immediate family members of the employees. |

- Entertainment expense qualifies for 50% tax deduction

Entertainment expense which wholly and exclusively incurred in the production of business gross income and NOT fulfilled either of above conditions, is subject to 50% tax deduction. - Promotion expense is part of entertainment expenseWith effect from YA 2014, promotional expense which carries entertainment element is allowed for:

a) 50% tax deduction; or

b) 100% tax deduction, if the expense fulfilled any of above conditions (1) to (8), item A above.Promotional expenses which wholly and exclusively incurred in the production of business gross income and do not have entertainment elements is allowed for 100% tax deduction. - Process Flow Diagram of Entertainment Expense

Conclusion

It is important for business to assess the nature and criteria of the spending on entertainment in order to benefit from tax deductions.

Contentious Tax Issue

Based on your understanding, are following transactions allow for tax deduction?

| No. | Transactions | Allowed for tax deduction (50% / 100%)? |

Not allowed for tax deduction |

| 1 | Entertainment allowance paid to employee to reimburse them for entertainment expenses incurred on behalf of the employer. | ||

| 2 | Entertainment expenses for annual general meeting (AGM) of company. | ||

| 3 | Free trips as an incentive to sales agent for achieving sales target. | ||

| 4 | Cash contribution for customer’s annual dinner. | ||

| 5 | Gift with business logo for customer’s annual dinner. | ||

| 6 | Gift without business logo for customer’s annual dinner. | ||

| 7 | Gifts of flower for customer’s opening of new outlet. | ||

| 8 | Hampers for customers during festive seasons. |

Any questions, please feel free to reach us.