Are You A Tax Resident in Malaysia?

Background

Residency status of an individual can impact on his/her tax liability.

Individual who is a tax resident is entitled for personal reliefs and tax at scale rate; however, this is not applicable for non-tax resident.

Therefore, it is crucial for taxpayer to understand his/her residency status.

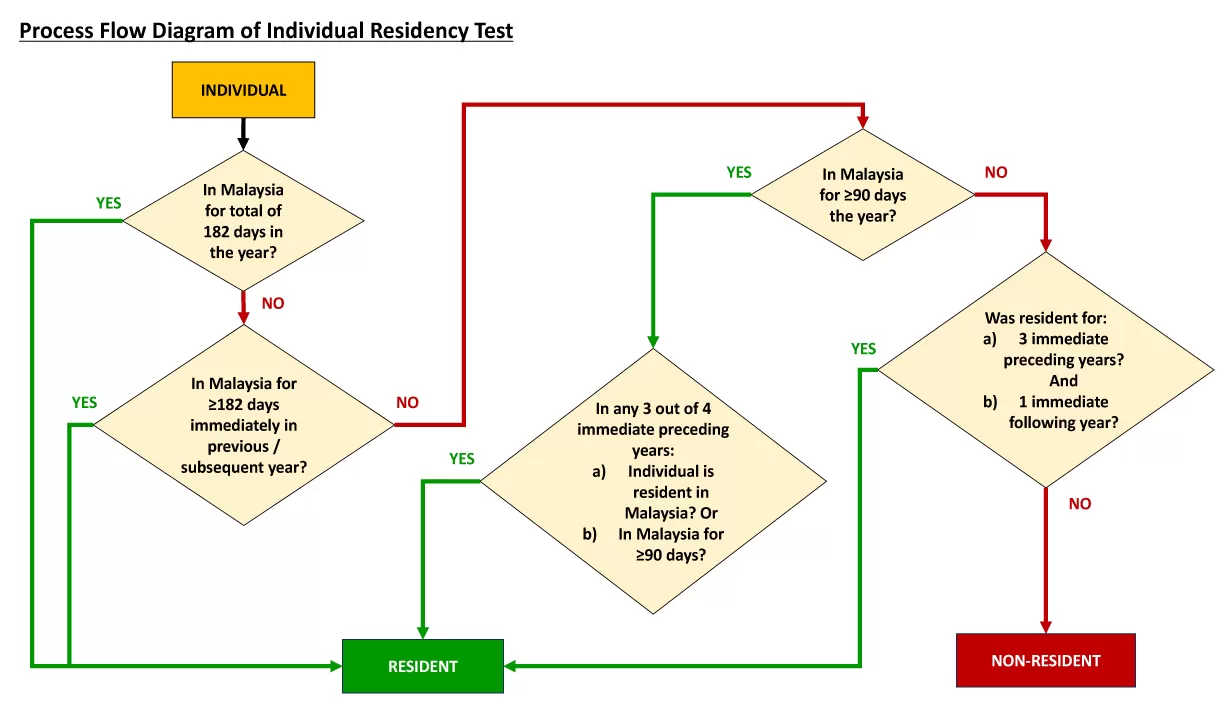

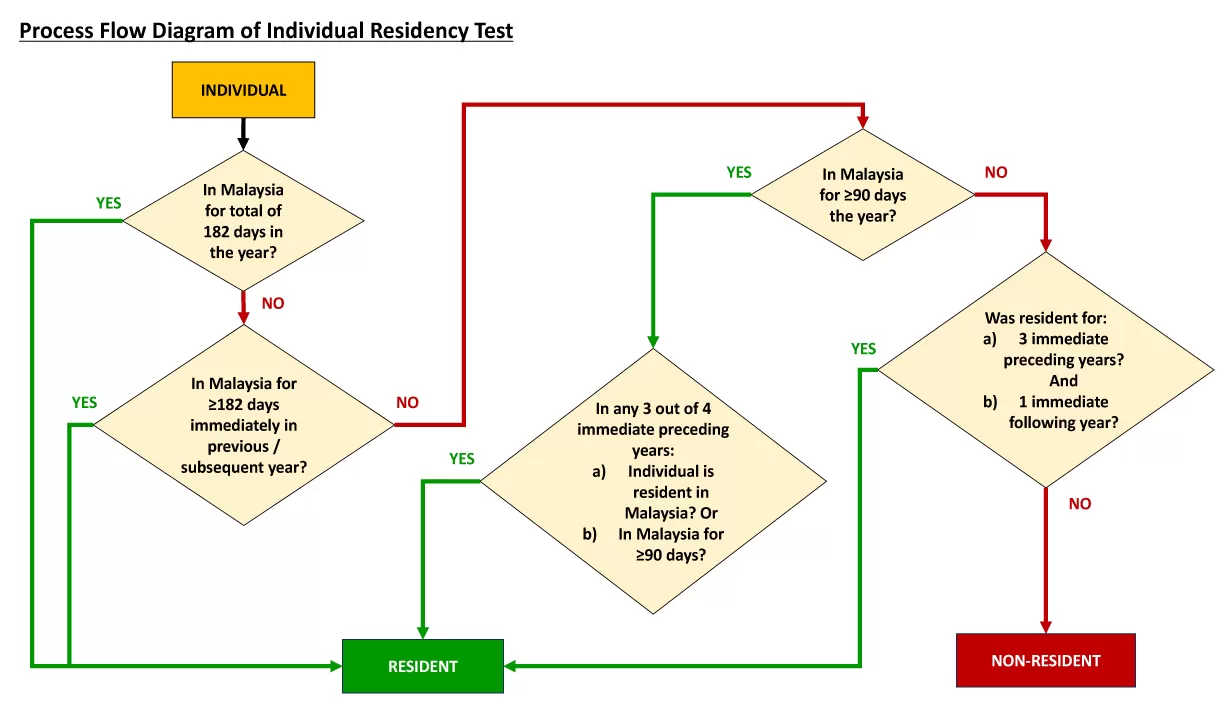

Check out below on the Process Flow Diagram of Individual Residency Test for ease of reference.

Tax Law and Regulations

- Section 3 of Income Tax Act 1967 (“the Act”)

“Subject to and in accordance with this Act, a tax to be known as income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia.” - Paragraph 28, Schedule 6 of the Act, amended with effective from 1 January 2022.

“The income arising from sources outside Malaysia and received in Malaysia by any person who is not resident in Malaysia.” - Section 7 of the Act, on residence of individuals

Application

| RESIDENT | NON-RESIDENT | |

| Scope of charge | Tax on income:

|

Tax on income accruing in or derived from Malaysia. |

| Eligible for tax exemption on income received in Malaysia form sources outside Malaysia (“foreign source income”) | No | Yes |

| Eligible for tax exemption on income from short-term employment of ≤60 days | No | Yes |

| Eligible for personal reliefs | Yes | No |

| Eligible for double tax relief | Yes | No |

| Income tax rate | Graduated rates: 0% – 30% | Flat rate: 30% |

- Tax residency status of the individual has no connection with his/her nationality, place of domiciled.

- An individual is a resident in Malaysia in the basis year for a year of assessment under following circumstances:

- An individual is deemed to be present in Malaysia for a day if he/she is present in Malaysia for part or parts of that day.

Contentious Tax Issue

Based on your understanding, is the individual a tax resident in Malaysia?

| No. | Transactions | Yes / No |

| 1 | Mr. A arrives in Malaysia for the first time on 1 March 2022. His period of stay in Malaysia is as follows:

Mr. A leaves Malaysia on 31 October 2022. |

|

| 2 | Mr. B arrives in Malaysia for the first time on 1 September 2022. His period of stay in Malaysia is as follows:

Mr. B leaves Malaysia on 31 May 2023. |

Any questions, please feel free to reach us.